The Trustees Have Failed

What is the future of a country that rips off the young?

A Story of Generations

I often reflect on the concept of generational responsibilities. That each generation, whether mine or yours, has the same type of supportive role to the other for the common good, although the obligations may be different. Let me put this another way:

Every generation is the caretaker of the generations that came before, and the trustee of those who will come after.

To explain by example: a child enters this world under the care of their parents. And the parents leave this world being cared for by their children. These are general observations (and aspirations) that leave out everything in between and all those little moments that define care.

To be more specific, and to hopefully state the obvious, caring for a child isn’t just a roof over their head and three meals a day. It’s teaching them values, being an example for them to follow, making them feel safe. It is making a marriage work for the benefit of the children and not divorcing for the convenience of the adults. Ensuring, as best we can, their future.

Then as we age, we see our parents start to fight with the parts of their daily lives they once did with ease. Their struggle is our struggle, though the struggles are different. Each day a brush more diminished until we say goodbye.

Both stages are touched by sadness, as if a gentle hand squeezed yours. Dare I say acute melancholy. Parents watching their children slowly grow up and children watching their parents slowly grow old.

I say all that for a reason. Take the relationship of a parent and a child and put it in generational context: being a trustee of those who are here, and for those to come, means ensuring that the younger generations have the tools to build their future. The institutions established by our ancestors serve the same purpose. The common good endures when we pass.

Do we judge trustees and institutions - and by extension, generations - by what they preserve and pass on?

It’s dangerous to criticize a whole group in these times (accusations of stereotypes or whatever) and I hope you understand that a generation can be criticized even if every member of the generation didn’t do wrong. If the one generation sold out younger generations (and they did sell them out), it doesn’t mean they’re all greedy. It’s the forest and not the trees, the big picture and not each individual pixel. I’ll even concede this is the flaw of all generations, though perhaps some did it better than others.

Greed and the Price of College

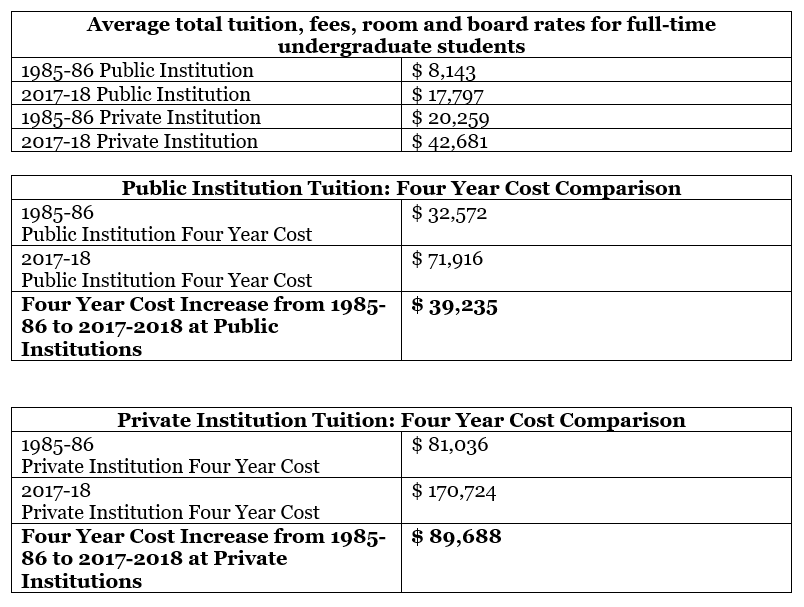

With that said, turn your eyes to the trustees who abused their power. Over the past 30+ years the cost of attending college – both private and public – has grown exponentially. The numbers below are 2019 figures from the U.S. Department of Education’s National Center for Education Statistics and reflect the increase of the cost of higher education.

Per these Department of Education figures, students are now paying anywhere from approximately $72,000 to $170,000 to get a four-year degree. An increase of $39,000 to nearly $90,000 without taking into consideration the interest on the loans. Put into simple terms, a student may be billed $100,000 for college but over the long term the cost can double.

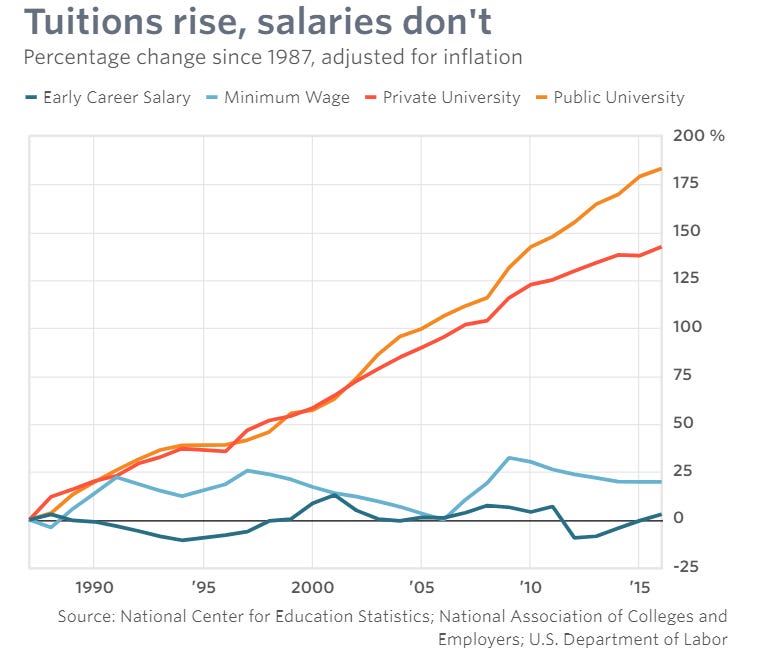

Meanwhile, wages haven’t kept up.

The Cost of Student Loans: The Numbers and Beyond

The student loan horror stories are everywhere if you care to look. You probably know people struggling with student loans who endure in silence. These are college graduates giving plasma to pay for groceries. One woman I spoke with documented how her husband has paid twice the original balance of the student loan – and still owes an amount so large that they will likely pay through retirement. These are debts that are never meant to end.

There’s the story of a 1990s law school graduate borrowed around $55,000. He struggled to make ends meet and now owes “well over $300,000.” Maybe the servicing companies can rob his corpse when he dies. This is what happens when you start viewing people as objects: you extract from them everything you can and leave them to deal with the fallout. Servitude until death.

Debt and Misery

If you haven’t faced crippling student loan debt then it’s hard to understand what these young people face. Economically, they can’t buy homes because their savings – which would go towards a down payment – are paying the interest on the student loans. If we get creative with a driving metaphor, plans for the future take a backseat to high balances and high interest. In the worst cases the future is locked in the trunk, being driven beyond the city limits to be shot and burned in some remote field.

Psychologically, the results of loan debt can be devastating. Hope is for the young – except for those with student loans. They just have resignation. It’s the anxiety of drowning, fighting to stay near the surface as the $100,000 weight around their neck pulls them down. It’s the hopelessness and despair of paying everything you can afford month after month after month and watching the principal barely move. It’s a week’s worth of bologna sandwiches and eggs and instant oatmeal so you can pay your bills or treat yourself to an actual meal at an actual restaurant. It’s walking outside and praying your car hasn’t been repossessed.

The Greed Starts at the University

All of this is a great profit machine for the colleges. The University of Texas at Austin has an endowment of $31 billion. An in-state student at that school can graduate with over $75,000 in debt, counting tuition and living expenses. The trustees - those running the universities - are doing well for themselves.

Over on the east coast, Harvard’s endowment is an obscene $40.9 billion. It appears that the purpose of the endowment is to serve itself – to eat and grow to as large a size as possible, to expend as little as possible and get as fat as the market allows. Gluttony.

Costs are only cut when the cuts serve their interests. During the 2020 COVID-19 pandemic, Harvard instituted austerity measures and caused quite the controversy within its student body when it considered laying off its dining workers (technically contractors) without some sort of compensation. It took a bit of protest for Harvard to cut them something – the school wasn’t exactly volunteering to help those workers living paycheck to paycheck. While this went on, Harvard’s president and investment team continued to earn millions of dollars a year. True compassion from a liberal institution where only 1% of its professors call themselves (perhaps privately, if not publicly) “conservative.”

The United States government has been no help. In fact, they helped feed this monster – and have failed to stop students from being consumed by its appetite. In 2005, Congress exempted “all forms of student debt, public or private . . . from discharge in bankruptcy, absent a showing of ‘undue hardship.’” Not an easy task in bankruptcy court.

The Blame Goes Around - and Comes Back to the College

Contrary to popular belief in some conservative circles, however, all the blame for the increased cost of a college education doesn’t lie on Congress or the government as a whole. Certainly, the availability of guaranteed and loans allowed costs to increase and the student loan crisis to flourish. But the greed starts with the schools. The availability of loans didn’t require prices to rise.

To this you may say that the students took out these loans and should be on the hook for their debt: “Personal responsibility!”

I don’t necessarily disagree with that. There’s a moral duty to pay debts that we all recognize. Perhaps we should also consider there are moral duties governing lenders. If we continue on the path of personal responsibility, here’s another question to consider: What is the responsibility of those who created and benefit from this perverse system?

I’ll also add that there’s danger in the extreme. We allow for credit card debt to be discharged at bankruptcy. We allow for corporations to go through bankruptcy and be restructured. Personal or corporate bankruptcy all involve bad decisions with debt or in some cases an economic downturn. Sometimes both. Sometimes shit just happens.

Why treat student loans so different? Could it be to protect not the debtor, but the colleges making obscene profits and the institutions financing and collecting the debt?

This isn’t to say that I’m proposing the answer right now, though the answer requires some concerns to be addressed. This is a societal problem that requires an equitable solution. One that allows for balances to be paid without the punishing interest. A solution that puts some of the burden on the colleges and not just the students. An easier forgiveness of debt for those who absolutely need it. There must be a better way to solve the problem the trustees created.

Debt: The Inheritance of Future Generations

Now consider that all generations have a duty to preserve our inheritance for those yet to be born. What will their inheritance be?

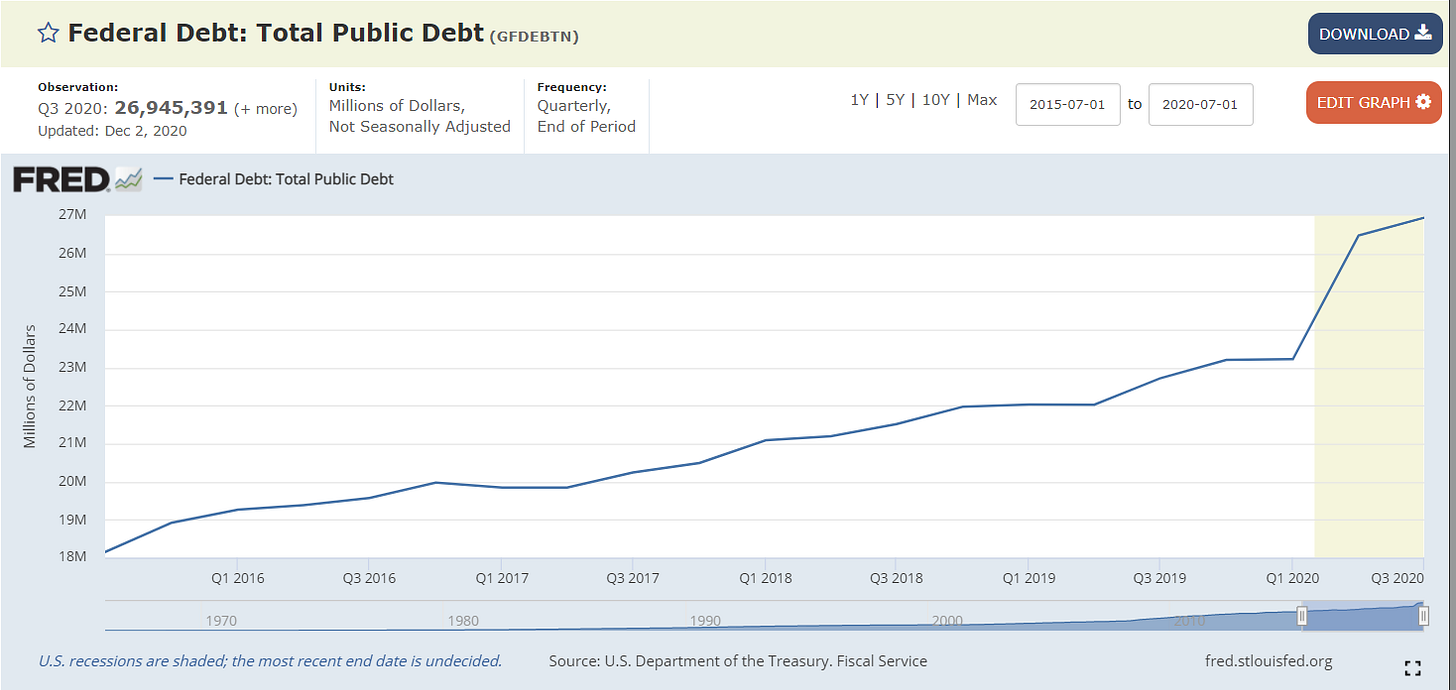

Reckless government spending and the accumulation of national debt is the best example of a breach of that duty that will be paid by future generations. The U.S. national debt (as of February 2021) is nearly $28 trillion dollars. That comes out to $84,000 per citizen and $222,000 per taxpayer. The US federal debt to GDP ratio has increased from 34.72% in 1980 to 128.89 in 2020. And it continues to grow, as seen in these December 2020 figures.

What costs will future generations bear for the extravagance of today? We have an idea of the answer, even if there are disagreements on the specifics. Those with forked tongues undoubtedly advancing the interests of their masters or their political allies take the counter-intuitive position that debt doesn’t matter.

We know otherwise. The ancients told us debt is slavery. (Proverbs 22:7: “The rich ruleth over the poor, and the borrower is servant to the lender.”) It is death: “To die is a debt we must all of us discharge.”

Many experts at least agree that these dangerous levels of debt can lead to inflation, prolonged recessions, high unemployment, and in quite possibly the ruin of America. And our mediocre ruling class, those who are good at getting elected and bad at governance, continue to spend. They get all the benefits and incur none of the costs.

A Contrast

Yet as the younger generations get much grief (some of it being deserved) for taking loans and selfies, for entitled behavior, for demanding promotions with little experience, look what happens when they are asked give things up for the benefit of others. The COVID-19 pandemic and shutdowns, which are ongoing as I write this, have been a real-time demonstration of generational priorities and sacrifices. It is a generational contrast.

The offerings of ordinary folks made during the pandemic– the sacrifices of the cooks, the janitors, the servers and bartenders, the small business owner – are substantial. This isn’t just a couple missed paychecks. This is about people getting no income when they already have so little. It’s auctioning restaurant equipment and locking the doors. This is paying half the month’s rent because you need the rest of your money for gas and groceries. It is the generation without wealth – in large part, the younger generation – making the sacrifices.

And the sacrifices are for whom? The older generation, the generation that is most at risk from COVID-19. The “greater good.”

When considering the sacrifices of the young during COVID – those sacrifices made for the “greater good” – how much worse is the older generation’s refusal to sacrifice small economic gains so younger generations wouldn’t be burdened with student loan debt for the next 20+ years?

Where do we go from here?

Things need to change. These are policies not based on the common good, or dare I say love, but on greed and cynicism. A country has no future if the future spends its life paying for the past.

A hope emerges from this: that we one day relate to younger generations in the same way parents relate to children. That we look to ourselves as trustees. That we see ourselves as guardians of an inheritance. That we look to others not as objects but as fellow citizens.

That we remember we are caretakers of those who came before and trustees for those who will come after.

What does it say about the higher education system (and the system overall) that they are not only willing to rip off the students with outrageous costs, but also knowingly give them a substandard product...?

I'm generally someone who's big on personal responsibility. However, I do think that the student loan crisis is unique. I just now paid off my student loan this past spring. I'm 38 years old. Had I not had a few big chunks of money coming my way, that could have potentially been many more years struggling to get rid of that thing. What is different about the student loan crisis is that these kids are signing on to loans without any guidance from their parents and no one advocating for them. I was trying to be responsible and lived in the dorms for three out of my four years in college until I realized that it would be cheaper for me to rent than to live in the dorms. They are concrete boxes and they cost as much or more than up at apartment. The entire system truly is predatory because these kids have no concept of how much money they will actually make when they graduate and they have no concept of how much money that they will need to make for all of their various expenses.