A deal that would almost make Jeffrey Epstein jealous.

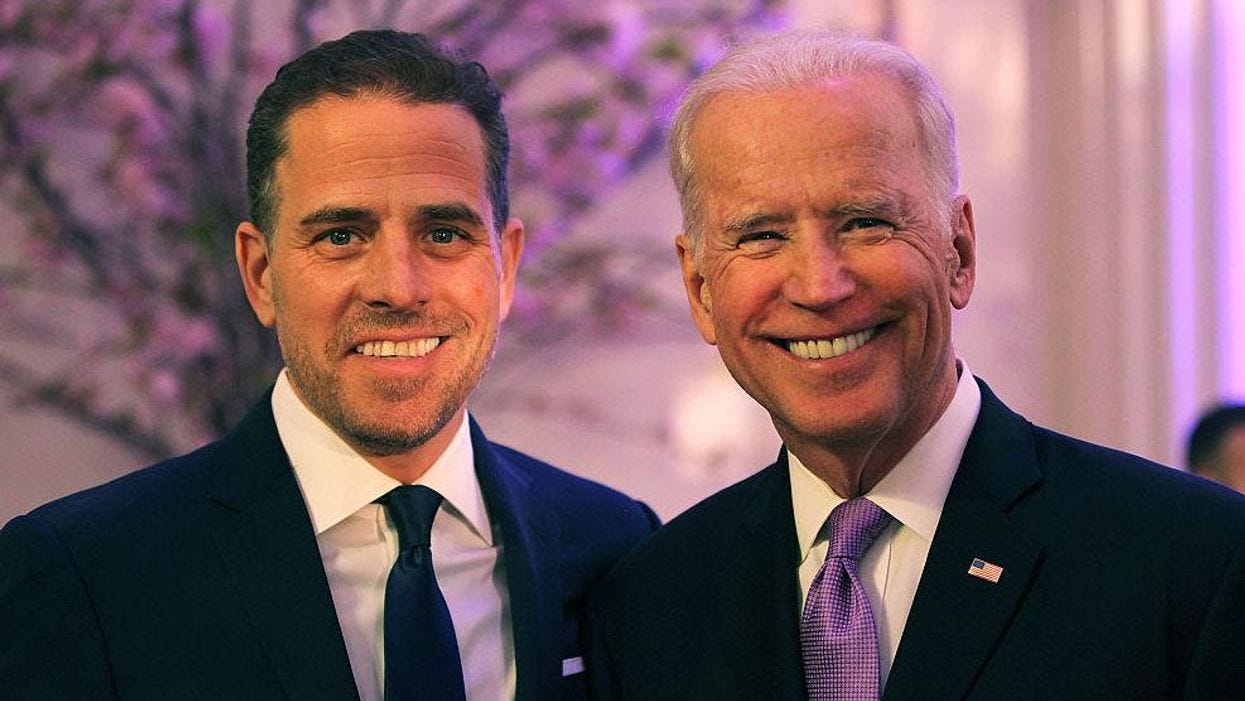

Hunter Biden has reached a deal with his father’s Administration, pleading guilty to two misdemeanor counts of willful failure to pay federal income tax, in violation of USC § 7203. He further agreed to enter a pretrial diversion agreement with respect to the charge of possession of a firearm by a person who is an unlawful user of, or is addicted to, a controlled substance. Prosecutors have agreed to dismiss the firearm charge “if he completes a two-year period of probation.”

The tax charges stem from Hunter Biden failing to pay income tax in 2017 and 2018, despite receiving taxable income in excess of $1.5 million for each of those years. The firearm charge relates to the 2018 possession of a firearm while he was an unlawful user/addict of illegal drugs.

It has been reported that Hunter will likely not face jail time for these charges. If true, this a deviation from the norm. There are a number of examples of less egregious tax evasion cases or 26 USC § 7203 cases where the defendant receives a tougher punishment, whether through a felony conviction or prison time. One such case involved a defendant receiving 6 years maximum for violating 26 USC § 7203 (failure to file Forms 8300). That case didn’t involve hiding millions of dollars in income from the federal government via shell companies.

A more comparable case involved Wesley Snipes, who served three years for tax evasion. For further reference, courtesy of our friend Mike Cernovich, the US Sentencing Commission, calculated that “the average sentence for tax fraud offenders was 16 months.”

More important for Hunter – and for his father (and their family) – is that this appears to end the DOJ’s investigation into the Bidens. I say “appears” because there’s this caveat from the press release of Davi Weiss, the US Attorney for the District of Delaware: “The investigation is ongoing.”

Keep reading with a 7-day free trial

Subscribe to The Reactionary to keep reading this post and get 7 days of free access to the full post archives.